Distribution

Actual Distributions

| 15th Fiscal Period (Ended December 31, 2023) |

Total distributions per unit (including surplus distributions) |

||

|---|---|---|---|

| Distributions per unit (excluding surplus distributions) |

Surplus distributions per unit | ||

| 3,820 yen | 3,461 yen | 359 yen | |

The calculation period is from July 1, 2023 to December 31, 2023.

Eligibility to receive distributions is limited to registered unitholders of record as of December 31, 2023.

The final trading day with the distribution rights at the Tokyo Stock Exchange was December 27, 2023.

Forecast Distribution

| 16th Fiscal Period (Ended June 30, 2024) |

Total distributions per unit (including surplus distributions) |

||

|---|---|---|---|

| Distributions per unit (excluding surplus distributions) |

Surplus distributions per unit | ||

| 3,619 yen | 3,259 yen | 360 yen | |

The calculation period is from January 1, 2024 to June 30, 2024.

The above distribution forecast is based on certain assumptions, and the actual distribution may vary due to the acquisition and/or disposition of investment properties, changes in the real estate market, and changes in other conditions affecting CRE Logistics REIT. Moreover, the above forecast is not a guarantee of actual payment of distributions.

Eligibility to receive distributions is limited to registered unitholders of record as of June 30, 2024.

| 17h Fiscal Period (Ended December 31, 2024) |

Total distributions per unit (including surplus distributions) |

||

|---|---|---|---|

| Distributions per unit (excluding surplus distributions) |

Surplus distributions per unit | ||

| 3,654 yen | 3,291 yen | 363 yen | |

The calculation period is from July 1, 2024 to December 31, 2024.

The above distribution forecast is based on certain assumptions, and the actual distribution may vary due to the acquisition and/or disposition of investment properties, changes in the real estate market, and changes in other conditions affecting CRE Logistics REIT. Moreover, the above forecast is not a guarantee of actual payment of distributions.

Eligibility to receive distributions is limited to registered unitholders of record as of December 31, 2024.

| Total distributions per unit (including surplus distributions) |

|||

|---|---|---|---|

| Distributions per unit (excluding surplus distributions) |

Surplus distributions per unit | ||

| yen | yen | yen | |

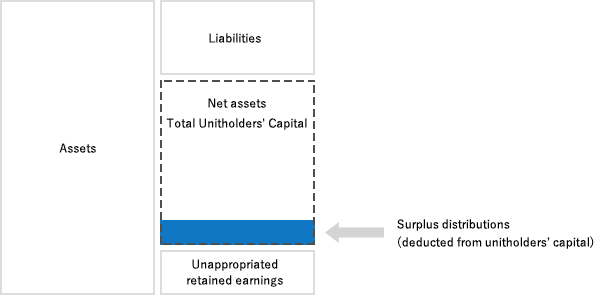

Distributions in excess of retained earnings

One characteristic of logistics facilities is that the ratio of building value to land is typically high, and so depreciation expense tends to be higher than for other asset classes. Thus, CRE Logistics REIT can distribute an amount of cash in excess of retained earnings with a maximum amount as set forth in legal provisions, etc. (including regulations pursuant to The Investment Trusts Association, Japan) if CRE Logistics REIT has deemed such distributions appropriate for the purpose of maintaining stable distribution or reducing tax burden.

The basic policy of CRE Logistics REIT is to make distributions in excess of retained earnings each fiscal period on an ongoing basis (“Ongoing Surplus Distributions”), in principle, upon examination of alternative uses such as the execution of repair plans or capital expenditures, the repayment of borrowings, and allocation to funds for the acquisition of new properties. Following comprehensive judgment, for the time being we have decided to target Ongoing Surplus Distributions equivalent to 30% of the depreciation expense for the relevant fiscal period.

In addition, we may also make surplus distributions on a one-time basis (“One-time Surplus Distributions”) to maintain the stability of our distributions per unit in the event that distributions per unit are expected to decline to a certain degree due to dilution of investment units or a substantial increase in costs as a result of our financing activities, such as the issuance of new investment units. However, we intend to make surplus distributions (including the Regular Surplus Distributions and the One-time Surplus Distributions) in an amount not higher than 60% of depreciation expense for the relevant fiscal period.

The following chart illustrates the impact of surplus distributions (return of capital).

The above is merely an illustration and does not show the ratio, etc. of the distribution in excess of retained earnings (return of capital) to the net assets in the balance sheet. In fact, the amount of distributions in excess of retained earnings (return of capital) could change or may not be made depending on a range of factors, including the economic environment, trends in the real estate market, and our portfolio and financial conditions.