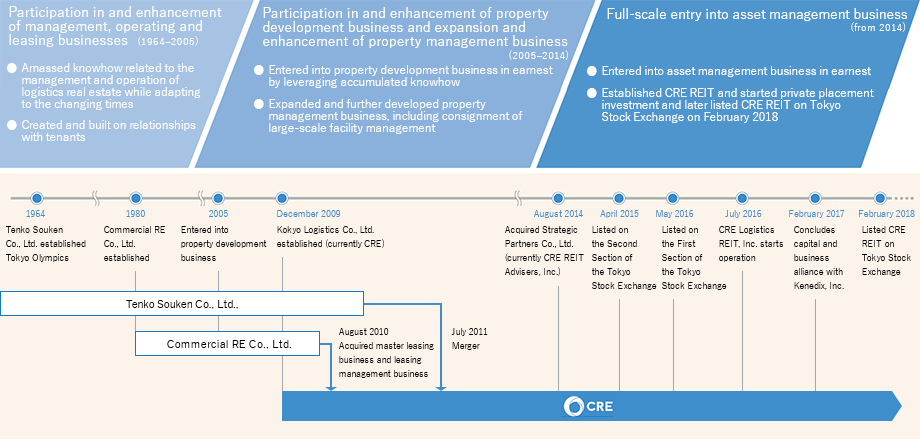

About the CRE Group

Accumulation of Knowhow of the CRE Group, in the Logistics Real Estate Market in Japan for over 50 years, and Accelerating Future Property Development Business

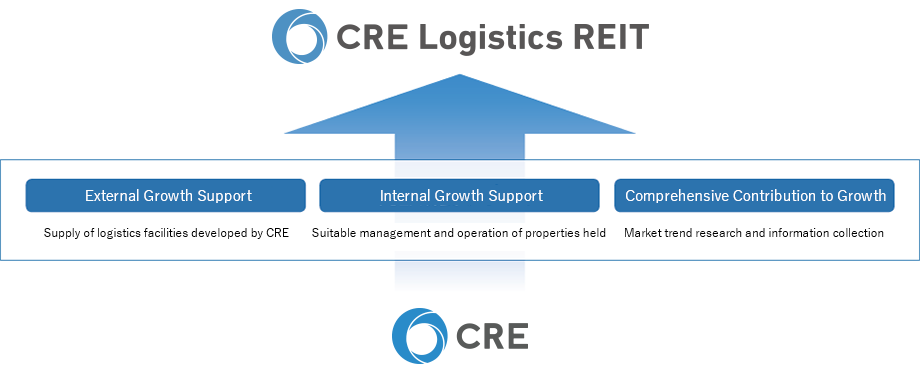

Strong Sponsor Support

| ● | CRE Logistics REIT will receive comprehensive and wide-ranging support as well as support for both external growth and internal growth driven by the management, operation and development capabilities of CRE, a specialty logistics real estate developer by way of a sponsor support agreement. |

|---|

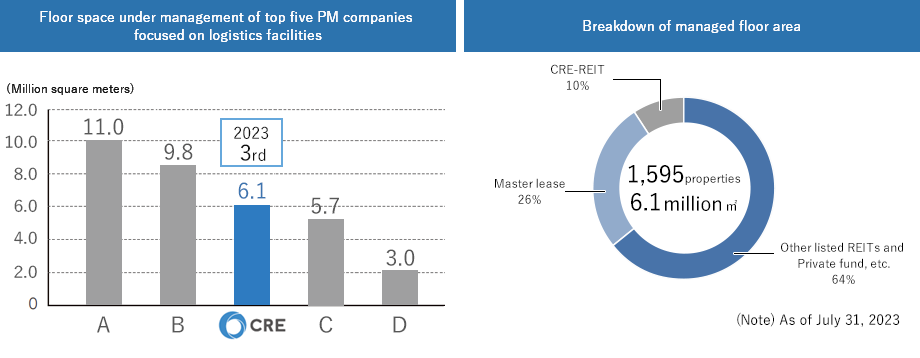

CRE boasts a management track record that sees it ranked 3rd(Note1) in terms of floor space under management in Japan(Note1) as a property management (PM)(Note2) company focused on logistics facilities and has a proven track record in providing services to other companies.

| Source: | Prepared by the Asset Management Company based on the monthly Property Management magazine (November 2023 issue) |

|---|---|

| (Note1) | PM company focused on logistics facilities refers to a PM company for which at least 70% of floor space under management is made up of logistics facilities. “Floor space under management” refers to the total floor space managed for master lease properties and property management properties, and includes floor space under management for properties other than logistics related facilities. |

| (Note2) | The ranking of floor space under management in Japan among PM companies focused on logistics facilities is determined based on responses from 232 companies to a survey presented to PM companies. The rankings were determined upon responses from PM companies focused on logistics real estate extracted from the 232 PM companies that completed the survey. Please note that the rankings are only for the 232 PM companies focused on logistics real estate that responded to the voluntary survey and do not express rankings for all PM companies focused on logistics real estate. The same applies hereafter. |

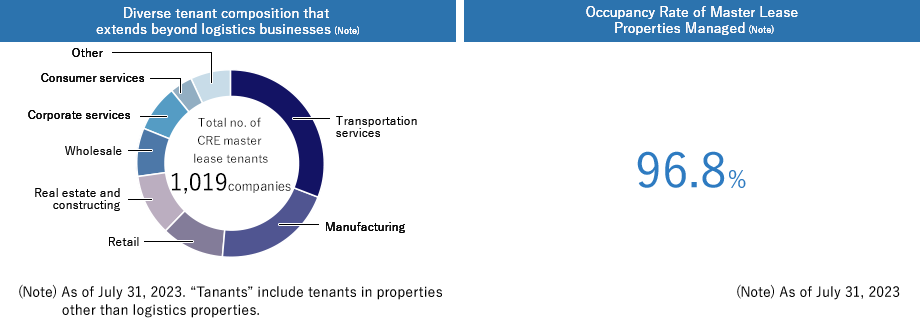

CRE’s Exceptional Leasing Capability