Climate Change

Awareness of Climate Change

The Paris Agreement adopted in 2015 set a common goal of limiting the global average temperature increase to less than 2°C compared with pre-industrial levels (non-binding target 1.5°C) and reducing greenhouse gas emissions to virtually zero by the second half of the 21st century. This is expected to result in a significant transition toward a decarbonization of society and the economy, including the strengthening of international frameworks to reduce greenhouse gas emissions and policies such as emission controls in Japan and overseas.

In light of this growing interest in sustainability in society as a whole, CRE REIT Advisers, Inc. (“the Asset Manager”), the asset manager to which CRE Logistics REIT, Inc. (“CRE REIT”) entrusts the management of its assets, is focusing on efforts for ESG issues, believing that addressing sustainability and ESG issues, including the response to climate change, will contribute to the strengthening of CRE REIT's competitive edge and the enhancement of its unitholder value over the medium to long term.

Above all, the Asset Manager recognizes that enhancing its resilience to socioeconomic changes brought about by climate change and physical changes in the global environment is essential for CRE REIT to secure sustainable and stable earnings over the long term.

Declaration of Support for the TCFD Recommendations and Participation in the TCFD Consortium

To promote the climate-related disclosure, the Asset Manager declared its support for the Task Force on Climate-related Financial Disclosures (TCFD) in February 2022 and participates in the TCFD Consortium, in which many companies in Japan supporting the TCFD participate.

In the TCFD Consortium, companies and financial institutions that support the TCFD recommendations are working together to pursue their efforts and discuss initiatives to promote effective corporate information disclosure and link disclosed information to appropriate investment decisions by financial institutions and others. Through its participation in the TCFD Consortium, the Asset Manager will engage in dialogue with companies that support the TCFD recommendations, gather information on good practices and promote climate-related financial disclosure in line with TCFD recommendations.

Information Disclosure Based on TCFD Recommendations

Governance

The Asset Manager has established the following framework to continuously and methodically promote initiatives for sustainability and ESG issues including the response to climate change. Please refer to the ”Policies and Promotion Structure” page for the framework at the Asset Manager.

Strategy

1.Conducting Scenario Analyses

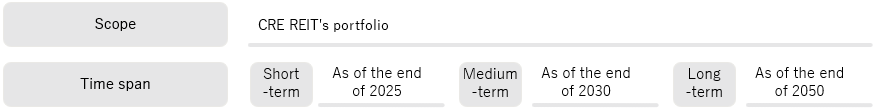

To identify and assess the impacts (risks and opportunities) of climate change-related risks on CRE REIT's portfolio and take them into account in its business strategy, the Asset Manager conducted a scenario analysis under two scenarios of 1.5°C and 4°C.

<Conditions for scenario analyses>

| Categories of climate change-related risks | Major sources of information referenced | ||

|---|---|---|---|

| 1.5°C scenario | 4°C scenario | ||

| Transition risks | Risks arising from new regulations, taxation, technologies, etc. associated with the decarbonization of society and economy | IEA (International Energy Agency) World Energy Outlook 2020 NZE2050 |

IEA World Energy Outlook 2020 STEPS |

| Physical risks | Risk of direct business damage caused by climate change, such as intensified natural disasters and long-term shifts in climate patterns | IPCC (Intergovernmental Panel on Climate Change) the Fifth Assessment Report RCP2.6 | IPCC the Fifth Assessment Report RCP8.5 |

<Overview of each scenario>

2. Identification and Assessment of Risks and Opportunities

Based on the scenario analyses, the Asset Manager has identified risks and opportunities and assessed their impact on CRE REIT's portfolio as shown in the table below.

| Events | Category | Financial impact | Degree of financial impact | |||||

|---|---|---|---|---|---|---|---|---|

| 1.5°C scenario | 4°C scenario | |||||||

| Short term | Medium to long term | Short term | Medium to long term | |||||

| Transition risk and opportunities | Policies and Legal | Introduction of a carbon tax Progress of emissions trading scheme | Risk |

・Increase in tax burden costs ・Increase in costs for promoting the conversion of properties to renewable energy ・Increase in the purchase of emission credits and emission control costs |

Medium | Large | Small | Small |

| Technology | Advancement of renewable energy and energy-saving technologies | Risk | ・Increase in costs for introducing new technologies |

Small | Small | Small | Small | |

| Opportunities |

・Reduction of expenses for externally procured utilities through the introduction of new technologies ・Increase in revenue due to sales of renewable energy |

Small | Medium | Small | Small | |||

| Market | Changes in tenant behavior | Risk | ・Decline in rent levels due to lower demand for properties with poor environmental performance |

Medium | Large | Medium | Medium | |

| Opportunities | ・Improvement in rent levels due to increased demand for properties with high environmental performance |

Medium | Medium | Small | Medium | |||

| Changes in investor and lender behaviors | Risk | ・Increase in financing costs due to a declining reputation for ESG initiatives |

Small | Large | Small | Small | ||

| Opportunities | ・Decrease in financing costs due to an improving reputation for ESG initiatives |

Small | Medium | Small | Small | |||

| Reputation | Change in reputation from the local community | Risk | ・Compensation for damages caused by damage to the local brand ・Compensation for damages caused by the suspension of operations associated with a deterioration in the property image |

Large | Large | Small | Small | |

| Opportunities | ・Rising rent levels due to an increased advantage in securing employment as a result of an improved property image |

Medium | Large | Medium | Medium | |||

| Physical risk | Acute | Increase in property damage due to natural disasters such as flooding and typhoon | Risk | ・Increase in repair expenses and insurance premiums, etc. ・Loss of sales opportunities due to property damage |

Medium | Medium | Medium | Large |

| Damage to third parties due to property damage caused by natural disasters such as flooding and typhoon | Risk | ・Occurrence of claims for damages |

Small | Medium | Large | Large | ||

| Chronic | Higher average temperatures and an increase in extreme climate such as extremely hot and cold days | Risk | ・Increase in utilities and repair expenses, etc. due to the increased use of air conditioning |

Small | Small | Small | Medium | |

3. Measures to Address Climate-Related Risks

| Transition risks and opportunities |

|

| Physical risk |

|

Risk Management

The Asset Manager has established framework to continuously and methodically promote initiatives for sustainability and ESG issues including the response to climate change. At the Sustainability Promotion Committee, which is held at least once every three months, in principle, the Asset Manager evaluates and manages overall sustainability-related risks, including climate-related risks, and manages progress against various targets and response measures.

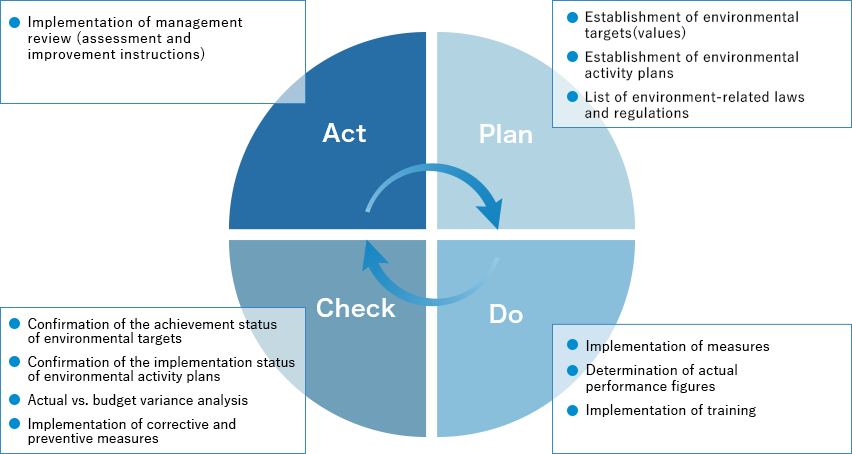

The Asset Manager has also established individual bylaws concerning important environmental issues to provide for practical measures to mitigate environmental burden.

In addition, the Bylaws for EMS Operations provide for system and processes to implement the "Sustainability Policies" and other rules and detailed regulations on sustainability promotion. Through the Sustainability Promotion Committee, which includes the Representative Director and President as a member, the Asset Manager is working to deepen each measure, etc.

EMS Diagram Based on PDCA Cycle

Metrics and Targets

To manage and monitor risks and opportunities, the Asset Manager has set the following new targets, etc. and monitors performance.

Greenhouse Gas Emissions

The Asset Manager will reduce annual emissions intensity related to energy consumption of CRE REIT's portfolio (market basis) (t-CO2e/㎡) by 46% from the fiscal year 2019 level by fiscal year 2030.

Coverage Rate for Environment-Related Data

The target of CRE REIT's portfolio coverage rate for energy consumption, renewable energy production, annual greenhouse gas emissions and water consumption is 100% continuously until the fiscal year 2027.

Percentage of Green Building Certifications Acquired

The Asset Manager will increase green building eligibility criteria (Note 2) properties to at least 95% of CRE REIT’s portfolio (based on total floor area) by fiscal year 2027.

Please refer to the ”Environment” page for the performance date.

| Note 1: | Fiscal year is April 1 until March 31. For example, fiscal year 2019 is from April 1, 2019 to March 31, 2020. |

|---|---|

| Note 2: | The eligibility criteria for green buildings in CRE REIT are DBJ Green Building Certification (5 Stars or 4 Stars), CASBEE Certification (S Rank or A Rank), or BELS evaluation (5 Stars or 4 Stars), and properties that have acquired or renewed, or will acquire or renew any of the relevant certifications will fall under the green buildings. |